APS 5

The Active People Survey (APS) provides robust and independent information about adult sports participation in England. Sport England’s director of sport, Lisa O’Keefe, discusses some of the findings in the fifth survey

In the most exciting year for sport in our generation, our eyes are fixed on the home Olympic and Paralympic Games and ensuring everyone maximises the opportunities the 2012 Games will undoubtedly bring for community sport. Understanding what’s happened in community sport in the seven years since we won the Olympic bid, in 2005, is helping to inform decisions and investments to grow participation over the next five years.

The headlines from the Active People Survey (APS) 5 show the number of people aged 16 and over playing sport at least three times a week has risen by around 630,000 since 2005/06 to 6.927 million people. But look a little deeper and we can see that this growth is not being seen uniformly across the population; in fact participation rates among 16- to 19-year-olds actually fell over the past three years.

Addressing that challenge is a major focus of Sport England’s strategy for 2012 to 2017. Our ambition is to ‘create a sporting habit for life‘ by ensuring that young people are regularly playing sport and to break down the barriers that, until now, have prevented young people from continuing their interest in sport into their adult life.

The latest survey results also illustrate that the gender gap persists in sport. While the number of men playing sport regularly has risen from 3.73 million to 4.24 million, women’s participation has failed to keep pace. It’s clear from this that more needs to be done to make sport attractive to women.

Sport by sport

With six years data to look at, what do we know about the relative popularity of different sports? Sport England measures the sports it funds on the number of people who are playing the sport at least once a week for 30 minutes.

Among team sports, the picture in 2010/11 looks similar to six years ago; football remains far out in front with over 2.1 million weekly participants, followed by cricket, rugby union, basketball and netball. The most likely change to that order appears to be among the final two, with netball showing a positive trend and basketball flagging, particularly in the last two years of APS figures. But overall the popularity of these team sports has remained relatively constant over the period.

The picture for individual sports is much more dynamic. Participation in cycling and athletics (which includes running) has increased by around 125,000 and 550,000 respectively, while swimming is down by around 460,000 over the six-year period. However, swimming remains comfortably the most popular sport with around 2.8 million weekly participants. Inevitably the changes in numbers of participants are largest among the bigger sports, but proportionately there has been some very impressive growth in some slightly smaller sports, notably table tennis and mountaineering.

Increasing participation in a challenging economic climate

So what impact is the challenging economic situation having on people’s sports participation?

Taking part in sport is a leisure choice involving discretionary spend. If an individual’s budget tightens, they will have lower discretionary spend. But do people stop playing sport altogether or do they protect their active lifestyle by switching to lower cost activities?

The choice to play sport also involves a time commitment – and the economic situation can have an impact on this. It may be argued that someone who loses their job has more time to play sport, but research suggests that any impact here is short lived, over-ridden in the longer term by increasing social isolation and the negative psychological effect of being unemployed. For a large number of people, challenging economic times mean increased demands in terms of working longer hours and increased pressure in the work environment.

Analysis from the survey, although not able to directly address all the questions raised above, does provide an interesting insight into changing patterns of participation – and the importance of economic factors in people’s decision to participate or drop out or at least do less sport.

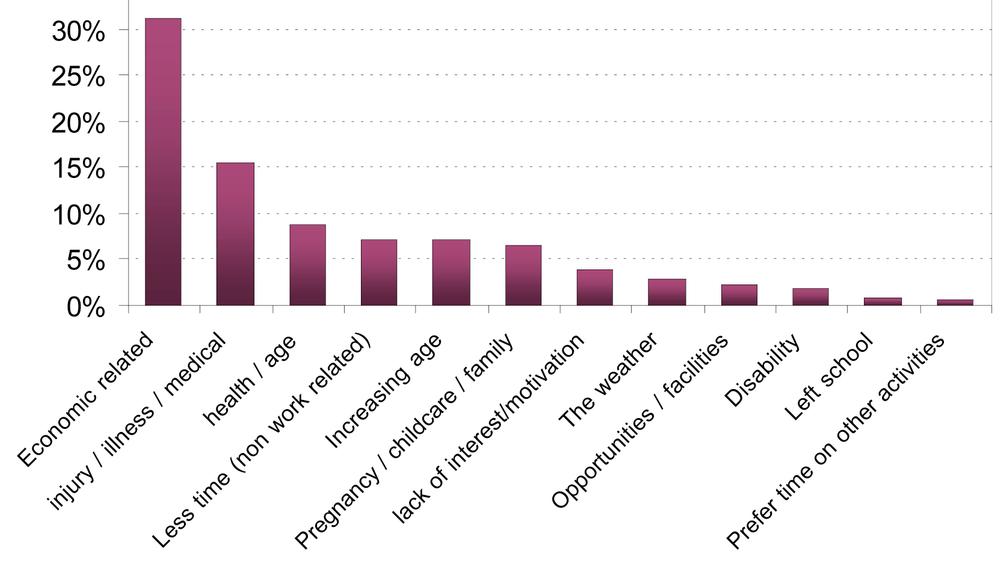

The survey asks people whether their participation rates are the same, higher or lower than at the same time last year. Roughly a half say they’re doing the same amount, with about a quarter claiming to be doing more and a quarter saying they’re doing less. Those respondents who say they’re doing less are asked why this is the case. The table below shows that around a third put this down to economic-related factors. These include specific reason such as: loss of job; less income; too expensive; and lack of time due to work commitments – such as longer hours or a longer commute.

These questions have only been asked since October 2009, but from the evidence of the first eight quarters, economic factors are becoming more important. This is supported by the government’s Family Spending Report 2011, which shows that the average weekly spend on ‘recreation and culture’ has dipped from £70.10 in 2005 to £58.10 last year.

We might expect economic factors to have a greater impact on time-consuming and higher cost sports such as sailing, but we should recognise that the economic situation is part of a complex set of influences that affect people’s leisure choices. Sports governing bodies, local councils and leisure operators are working to adapt their sporting offer to reflect people’s changing circumstances and lifestyle. For example, evening sessions could mitigate the impact of longer working hours, while pay-and-play or low-cost options could lessen the impact of a tighter budget.

Case study:

England Netball – using insight to drive participation

The Active People Survey (APS) shows that netball participation has grown by 18 per cent over the last five years, partly due to the success of programmes such as England Netball’s Back to Netball. This hasn’t happened by chance, but is built on the commitment the governing body has shown to putting their participants at the heart of everything they do – the Participant-Centred Approach.

Over the last 18 months, England Netball has undertaken a huge project to identify the behaviours, motivations, expectations, capabilities and needs of current netballers and potential future participants to help shape their offers, programmes and structures. They have combined information from a wide range of surveys, audits, questionnaires, in-depth interviews and recorded conversations. Through The Big Netball Conversation, the governing body has talked directly to nearly 10,000 netballers.

Data and insight derived from the APS has been a key component of this process. It has particularly supported understanding of the large number of participants accessing netball activities outside the sport’s traditional structures. While England Netball has a membership of just over 50,000 adult members, more than 130,000 on average play netball once a week.

The customer-centred understanding is already driving the development of the ‘My Game’ portfolio of

offers for current and potential netball players aimed at offering a game and product of choice for any participant and it will underpin the continuing evolution of England Netball’s strategic plan. The sport will also be continuing to talk to participants and building understanding of their needs as new data emerges – as with all successful organisations, the path to success starts and ends with understanding their customers.

Valued local measurement

With at least 500 respondents per local authority area, the APS provides a picture of participation at the local level. It’s one of the reasons the Department of Health, which helps to fund the survey, has chosen to add new questions to find out more about people’s BMI across England.

Local councils tend to focus on a wider measure of participation than the sport-specific figures reported nationally and regionally by Sport England.

In Oxfordshire, all five district local authorities have been working together since 2006 on a strategy for sport and active recreation through the Oxfordshire Sports Partnership.

The partnership’s managing director, Chris Freeman, says: “Having a consistent measure of participation means we can benchmark our progress against previous years. APS has helped us to understand participation and we’ve then used the market segmentation tool to develop the right activities in the right places.

“We’ve seen consistent increases in participation in Oxfordshire, demonstrating the value of the joined-up approach alongside the support of Sport England and the PCT for our Get Oxfordshire Active programme.

This has increased our influence, with sport now included in the Oxfordshire Sustainable Community Strategy and has led to a successful bid for additional funding for an activator post via the Health and Well Being Board.

Recreation Assistant

Duty Manager (Dry)

Swim Teacher

Swim Teacher

Chief Executive Officer, Mount Batten Centre

Swim Teacher

Swimming Teacher

Swimming Teacher

Company profile

Featured Supplier

Property & Tenders

Company: Knight Frank

Company: Belvoir Castle

Company: AVISON YOUNG

Company: London Borough of Bexley

Company: Forestry England