Feeling Buoyant

Benchmark data from the UK Spa Association shows that the nation’s spa businesses fared well in 2015

It’s been two years since the UK Spa Association (UKSA) launched its benchmarking programme and since bedding in, members are finding it a useful tool. “Whether a small day spa, or large group or chain, none of us can resist having a bird’s eye view of the competition and how we compare,” says Julie Speed, director of the UK’s International Beauty & Holistic Academy and the UKSA board member overseeing the benchmarking. “Information is key – where does our business sit on the comparison chart, what should we expect to be achieving, what’s realistic and what’s not? Should we employ more staff, build more therapy rooms, change our treatment menu, etc? Benchmarking is key to all of this.”

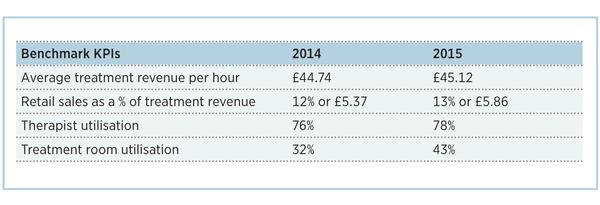

The latest data shows how UK spas fared between 2014 and 2015 and is based on a representation of 75 facilities. Participants tracked four key performance indicators (KPIs) on a monthly basis. With the number of members more than doubling and the association now in its third year, Speed says the data is “a truer and more robust representation of the activities within our membership”.

Revenues

Overall, the average revenue per treatment hour in UK spas grew in 2015 to £45.12 (US$65.18, €57.24) but as Table 1 shows, this is only a slight rise from the 2014 average of £44.74 (US$64.63, €56.76). Yet Liz Holmes, of consultancy Commercial Spa Strategies who previously oversaw 35 spa facilities for Virgin Active, remains positive. She says: “With [UK] inflation ending at 0 per cent in 2015, I would say a marginal growth in revenue per treatment hour is a good sign for the industry.”

Speed, who also owns the Cedars Health & Beauty Centre, concurs: “Any increase in treatment revenue is a good sign – even if it’s just 1 per cent.” She adds that prices remain tight for day spas as high street facilities compete with other smaller businesses with fewer overheads so it’s “very easy to price yourself out of the market and efficiency is key in all areas to maintain and grow treatment revenues.”

Leanna Kew, spa manager at the Bedford Lodge Hotel and Spa, echoes these thoughts. “An increase of only 38 pence per treatment hour could be considered disappointing,” she says, “but I think we have to look at the bigger picture and understand the importance of not alienating our customers who become familiar with our pricing structures and what to expect for their money.”

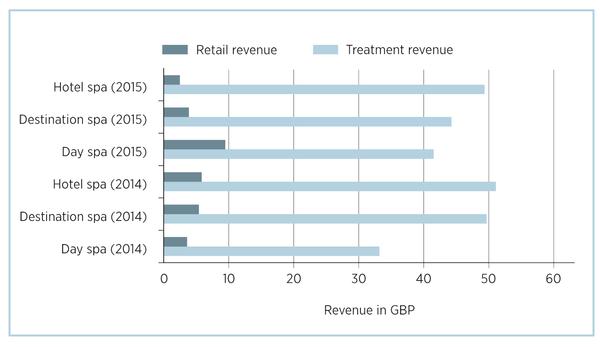

A closer look at the numbers in Graph 1 show that average revenue per treatment for hotel spas is higher than destination or day spas, at £48.98 (US$70.76, €62.14) compared to £44.30 (US$64, €56.20) and £42.08 (US$60.79, €53.39), respectively. This may come as a surprise considering destination spas often have more specialist treatments at a premium. Holmes, who’s also managed resorts spas such as at Rockliffe Hall, offers an explanation: “A combination of having a captive audience and expecting to pay a little more in a luxurious hotel environments may be behind the difference.” She also says that hotels, in the main, tend to focus efforts on driving bedroom rates and may overlook spa businesses and their promotional pricing strategies; so although they’re missing a trick to attract more customers the upside is better average spend.

Retail sales are still a struggle – or a key opportunity – for UK spas according to the benchmarks. Product revenues contributed only 13 per cent of spa sales in 2015, an increase of just 1 per cent from 2014. Figures (see Graph 1) show hotel spas with just 6 per cent of retail sales, destination spas with 10 per cent and day spas rocketing with retail sales of 22 per cent which equates to £9.25 (US$13.36, €11.74) per hour. Holmes, Speed and Kew all suggest that day spas are successful in this area because they probably offer more facials which are likely to lead to more product sales and that they’re also benefitting from local, repeat customers who regularly buy homecare products as part of their skincare routine.

Staff utilisation

Therapist utilisation is a strong point in UK spas, sitting at an impressive 78 per cent in 2015, up 2 per cent from the previous year which points to improved consumer confidence in spending. Kew comments: “This is a great reflection of the high demand for services we all see on a daily basis. The need to look after our wellbeing is recognised by such a large section of the public now and it feels like as soon as I add a new therapist to the team their column is quickly filled.”

Holmes feels it’s also an indication

of “spa managers who are becoming much stronger commercially and fully utilising the tools available to them to promote their business”.

Speed adds that more customers are also attracted and committed to appointments. She says: “With improved facilities for appointment reminders and social media to maintain client engagement, there has been a gradual improvement in therapist utilisation.”

If utilisation continues to rise, however, the challenge will be maintaining staff wellbeing and motivation, says Kew. While for Holmes, the main future industry concern is finding the good quality staff in the first place to fill vacancies.

Treatment room occupancy

In 2015, the UKSA benchmark scheme shows that treatment room utilisation was 43 per cent, an rise of 9 per cent on 2014. It’s difficult to pinpoint an optimum figure for treatment room utilisation as it will vary greatly according to spa type, location and attrition, but the upward trajectory seems promising.

Kew says: “This is really quite a strong result against 2014” and both her and Speed feel that as therapist utilisation is going so well, operators have confidence to seek additional staff to fill more treatment rooms. That said, it’s likely that operators will still look to improve occupancy in 2016. Holmes says: “Promotional off-peak packages and highlighting last-minute availability can improve occupancy but sustained quality growth through repeat business and referral create businesses with longevity.”

For Speed it’s about having a strong foundation. She says: “Build a team of therapists who can carry out a variety of services to avoid boredom and repetitive strain injury. Offer them support and guidance to progress and then explore employing new team members to fill [even more] treatment rooms.”

Kew concurs and adds: “Look towards results-driven and aesthetic treatments that encourage customers to visit regularly for courses to help with room occupancy.”

Overall improvement

Taking the growth of treatment room utilisation and the slight increase in other KPIs, the UKSA benchmarks confirm that the feeling of buoyancy in the industry is not part of the imagination, but a reality. Charlie Thompson, chair of the association says: “It’s great to see an overall improvement in performance of the industry at large.” In his role, the focus will be to encourage more UK spas to sign up to the association and the benchmarking scheme. He’s hoping to add even more KPIs to the programme this year with the long-term aim to drive standards and campaigns to represent the industry in the future.

Table 1:

Average Results Achieved Per Hour from UKSA Members*

Graph 1: Treatment and Retail Revenue Per Hour by Spa Type*

Treatment and Retail Revenue Per Hour by Spa Type*

About The UK Spa Association

Formed in 2013, the UK Spa Association (UKSA) was born from the amalgamation of two long-standing, but independent spa organisations in the UK. It now represents the industry with ‘one voice’ (see p348) and has 152 members, representing 75 spas in the country. Its aim is to reach 600 members by the end of next year.

To join UKSA or to participate in the benchmark scheme, contact general manager Lisa Barden.

Tel: +44 7794 258 624

Email: [email protected]

Duty Manager

Duty Manager Golf and Athletics

Leisure Centre Duty Manager

Leisure Supervisor (Development)

Recreation Assistant (Dry Site)

Party Leader

Cleaning Assistant

Duty Manager

Duty Manager

Centre Manager (Leisure)

Director of Operations

Fitness Motivator

Recreation Assistant/Lifeguard (NPLQ required)

Recreation Assistant

Swim Teacher

Swim Teacher

Chief Executive Officer, Mount Batten Centre

Swimming Teacher

Swimming Teacher

Company profile

Featured Supplier

Property & Tenders

Company: Knight Frank

Company: Belvoir Castle

Company: AVISON YOUNG

Company: London Borough of Bexley

Company: Forestry England