News report: Global Thermal Think Tank

How is the worldwide hot spring market developing and what are the latest trends? Jane Kitchen joins a gathering of thermal spa operators to find out

The inaugural Global Thermal Think Tank (GTTT) took place on 13-14 October at the Toskanaworld Hotel and Therme in Bad Orb, Germany, bringing together leaders in the hot springs industry from around the world for a packed day of presentations, networking and the exchange of ideas.

The meeting began with representatives from around the world giving short presentations on their hot springs culture, the types of hot springs in their market and current and future trends.

Mike Wallace, brand manager for Danubius Hotels Group – which operates wellness and thermal spa hotels in Hungary, Great Britain, the Czech Republic, Slovakia, and Romania – introduced the session, saying: “If we want to be truly global, it’s important to look at things from outside our own country” – a theme that permeated the spirit of the event, which focused on collaboration and open dialogue.

Asia’s hot springs mix business and pleasure

Samantha Foster, director of Thai-based Destination Spa Management, gave an overview of hot springs in Asia – the region with the most facilities and highest revenues.

Asia has 20,298 thermal bathing establishments, according to Global Wellness Institute (GWI) figures from 2013, generating US$26.7bn (€24.2bn, £22bn) in revenues.

Foster said 51 per cent of facilities are in three countries: China, Taiwan and Japan, which has more hot springs – locally known as onsen – than any other country.

In Japan, the onsen market is largely domestic-focused, with day, local public and boutique hotel operations (ryokans) touching a wide variety of price points and customers. Every hot spring has its own ‘onsen ID card’, which shows its origin, mineral composition and potential curative effects.

In China, there are more than 4,000 thermal bathing establishments representing US$12bn (€11bn, £9.9bn) in revenue, and the number of hot springs tourists is increasing by 20 per cent.

Facilities in China are varied and run the gamut from hot springs spas to sauna hot springs and those focused on rehabilitation. A recent trend is for hot springs resorts to incorporate conference facilities to increase occupancy during the week and low season, said Foster.

Entertainment hot springs, which can include full theme parks in addition to thermal bathing experiences, are growing in China, she said, and adding in the element of fun is another way to entice year-round business.

Projects a plenty in Australia

Charles Davidson, founder, CEO and owner of Peninsula Hot Springs in Australia, took a look at what’s happening with thermal water in the country, which boasts hot springs in every state – though only a few have been commercialised.

Several thermal resorts are under construction, including the Phillip Island Hot Springs in Victoria, a AU$10m (US$7.6m, €6.9m, £6.2m) development on the coast that will include 45 bathing pools of varying sizes, a day spa and treatment rooms.

Other Australian projects in the works include a hot springs resort in Warrnambool, Victoria; Tawaari Hot Springs in Perth; and a plan to turn an old coal mine into a thermal bathing establishment.

Davidson is looking to create a hot springs district in Victoria, where Peninsula Hot Springs is based, and is coordinating packages for tourists that include activities like biking, walking, swimming with dolphins and horse riding in combination with stays at different thermal resorts.

“It’s great for community-building, but it’s also great for our business,” said Davidson. “That collaboration is really important and hot springs have the ability to be the magnet for an area.”

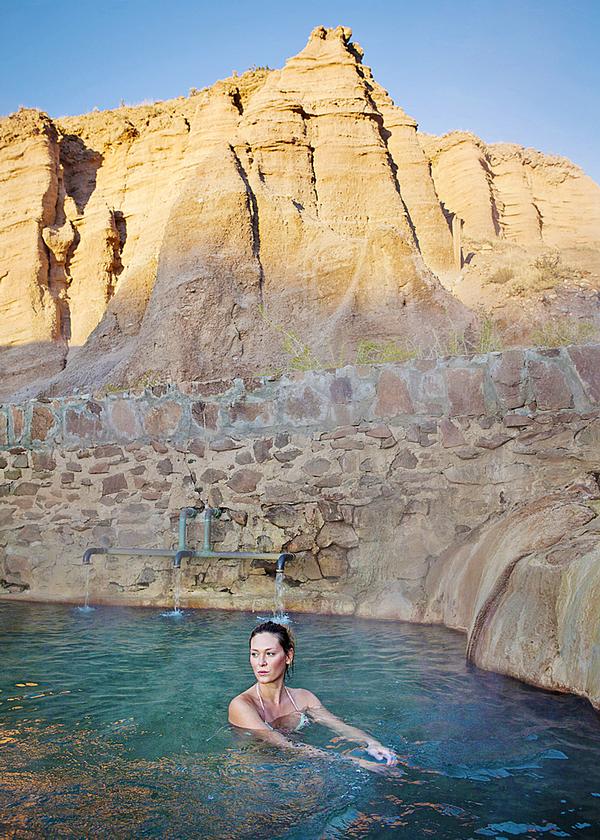

Demand driving development in the USA

Wendi Gelfound, director of marketing for Ojo Caliente Mineral Springs and Sunrise Springs, both in the US, took a look at the relatively young history of hot springs culture in America.

With 217 thermal and mineral springs locations in the US – including 106 that also have spas – the industry is responsible for US$488m (€446.7m, £401.3m) in revenue, according to the GWI. Locations with spas contribute a vast proportion – US$327m (€299.3m, £268.9m) – of the revenue.

While revenues are relatively small when compared to other areas of the world, Gelfound said “expansion is hot” and looked at GOCO’s planned extension of the famous Glen Ivy Hot Springs in California, as well as the Iron Mountain Hot Springs, under construction in Colorado. “It’s demand that’s driving this,” she added.

Europe’s thermal spas attract new audiences

Wallace then looked at GWI’s take on the European market, which boasts 5,035 thermal water establishments making US$21.7bn (€19.9bn, £17.8bn) in revenue.

After China and Japan, the European countries of Germany, Russia, Italy, Austria, Turkey, Hungary, the Czech Republic and Spain round out the top 10 nations in world in terms of the number of facilities and takings.

With a strong tradition of healing, combined with medical treatments and use of natural resources such as local muds, many European thermal facilities offer medical spa stays that include accommodation with full board, doctor and health examinations, and three to four treatments a day such as physiotherapy, massage, hydrotherapy, inhalation and electrotherapy.

While traditional customers in these European thermal spas are seniors, Wallace added that there’s opportunity for market diversification with a new breed of active seniors, as well as ‘wellness weekenders’, families and guests from the Middle East.

European thermal spas are also diversifying their offerings to attract this new clientele by adding larger water areas, more sauna experiences, new massage varieties, more modern medical treatment methods, and detox and weight-loss programmes.

The very fact that Europe has so many thermal spa facilities is a challenge. “There’s an oversupply of hot springs offering very much a similar product, so we need to find a way to diversify,” Wallace explained. But with an ageing and more health-focused population in the region, as well as a growing trend for natural treatments, he said there are many opportunities for the segment to expand – including investment possibilities for rundown, historic spa resorts.

More research needed

Wallace – and many others – mentioned the need for clinical trials backing the health effects of thermal waters as an important factor in growing the industry, plus a need to give people reasons to visit for prevention purposes as well as for medical treatments and relaxation.

James Clark-Kennedy, a hot springs researcher based in Australia, presented on bathers’ characteristics, motivations and experiences, looking at data from Peninsula Hot Springs. His findings suggest that thermal water can help boost guests’ mood, sleep and mental health. “If we can provide potential for reduced reliance on medication, that’s massive,” he said.

Meanwhile, Marc Cohen, a professor of health sciences at Australia’s RMIT University, spoke about the importance of starting research into the ‘bathing biome’ to understand the bacteria in water – both good and bad – in much the same way as we’re studying the gut biome. “Hot springs are the origin of life,” said Cohen. “Yet as far as I know, no one is studying the bathing biome. We have to look at water as a solution to many of the ills of the world. This group [GTTT attendees] – can come up with innovations that don’t just help this industry, but that have global impact.”

* The GTTT took place ahead of the 2016 Global Wellness Summit and we reveal the takeaway messages from this event on p80. Many GTTT attendees are involved with the summit’s Global Hot Springs Initiative which aims to drive sector development.

Fitness Instructor

Duty Manager

Swim Teacher

Team Leader

Duty/Operations Manager

Swimming Teacher (Saturdays)

Recreation Assistant

Commercial Fitness Manager

Exercise Referral Co-ordinator

Sport Centre Team Leader

Team Leader BSV

Lifeguard/Recreation Assistant

Casual Swim Teacher

Team Leader

Lifeguard/Recreation Assistant

Leisure Centre Deputy Manager

Duty Manager

Duty Manager Golf and Athletics

Centre Manager (Leisure)

Fitness Motivator

Recreation Assistant/Lifeguard (NPLQ required)

Swimming Teacher

Swimming Teacher

Company profile

Featured Supplier

Property & Tenders

Company: Knight Frank

Company: Belvoir Castle

Company: AVISON YOUNG

Company: London Borough of Bexley

Company: Forestry England