EUROPEAN RESEARCH: New research: The latest stats on the European fitness market

The health and fitness market continues to expand across Europe, according to new research. So where does continued growth potential lie? Karsten Hollasch and Herman Rutgers report

2015 was another year of strong growth for the European fitness market, as the total number of health and fitness club members increased by 3.9 per cent to 52.4 million. This is one of the topline findings of the new European Health & Fitness Market Report 2016, published in April by EuropeActive in co-operation with Deloitte.

This growth was driven not only by the continued growth of less developed fitness markets like Poland, Turkey and Russia, but also by new concepts that drew in additional members in the more mature markets of western and northern Europe.

In terms of market value, total fitness club revenues increased at an even higher rate of 4.9 per cent. While this was largely driven by exchange rate effects in the UK and Switzerland, the emergence of higher priced boutique clubs and special interest gyms also played a major role.

With a total market value of €26.7bn, fitness continues to rank as the number one sports activity in Europe. Not only that, but this value makes Europe the largest fitness market in the world, ahead of the US market, which was valued by IHRSA at €23.5bn in 2015.

The key players

The European chain operators were a key driver behind the growth. Compared to the previous year, the top 30 operators increased their membership by about one million to 11 million in total. The fastest-growing companies again included a large number of discount operators, underlining not only the continued market consolidation – especially in more mature markets – but also the increasing polarisation between the discount segment and the specialist boutiques and premium operators.

The leading operator in terms of membership remains the German discount chain McFIT/High5, with an estimated 1.37 million members – an increase of around 70,000. While the number of McFit-branded clubs grew in Italy, Poland and Spain, the company also launched its new High5 concept in April 2015, with a total of 10 clubs in Germany and one in Austria by the end of 2015. High5 clubs are smaller in size and focus on functional and strength training, priced at €9.90–€34.90 a month depending on the contract type.

Dutch low-cost operator Basic-Fit ranks second by member numbers, with approximately one million members at the end of 2015, followed by British low-cost fitness chain Pure Gym. After the addition of 35 former LA fitness clubs via acquisition, as well as the opening of 37 of its own clubs, Pure Gym was the fastest-growing fitness operator in Europe by member numbers – up by 260,000 to 680,000 members in 2015.

Fast risers also include the German discount chains clever fit (+105,000) and FitX (+95,000), which is estimated to have almost doubled its membership to 200,000. Another fast-growing fitness company, British low-cost operator The Gym Group (+83,000), successfully completed an IPO on the London Stock Exchange in November 2015.

Revenue leaders

The European revenue ranking is led by British operator Virgin Active, which operates 142 clubs in Italy, Portugal, Spain and the UK with estimated total revenues of €485m in 2015. In April 2015, an 80 per cent stake in Virgin Active was acquired by South African private equity firm Brait, while 20 per cent remained with Richard Branson’s Virgin Group.

Ranking second by revenue is fellow British-based operator David Lloyd Leisure (€460m), followed by Scandinavian market leader Health & Fitness Nordic (€321m) and McFIT/High5 (€268m), as well as the British operators Fitness First (€246m) and Nuffield Health (€230m).

While three of the top 10 operators in revenue terms state annual revenues (excluding VAT) of more than €1,000 per member, three others – McFit/High5, Basic-Fit and Pure Gym – earn less than €300 annually per member.

M&A activity

Health clubs remained highly attractive to investors in 2015, from both inside and outside the industry: there were 19 M&A transactions in 2015, the same as the previous year and twice as many as two years ago.

M&A activity was also strong on the supplier side, with Precor’s takeover of Queenax in June 2015, Nautilus’ acquisition of Octane Fitness in December 2015, and Life Fitness’ purchases of SCIFIT in July 2015 and Cybex in January 2016.

Overall, 2015 was another year of strong growth for the global commercial fitness equipment industry, which has an estimated market value of €2.65bn. The five leading B2B manufacturers – Life Fitness, Technogym, Johnson Health Tech, Precor and Cybex – accounted for 72 per cent of the market and saw 14.6 per cent growth in 2015 (influenced by currency effects and the strong US dollar).

Further growth potential

Although the market has expanded rapidly in the last two years – from around 46 million members in 2013 to 52.4 million members in 2015 – growth potential remains.

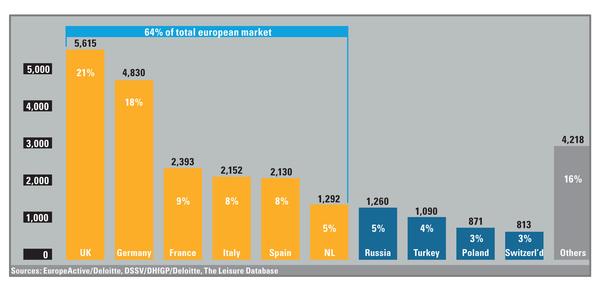

While Germany (9.5 million members / €4.8bn revenue), the United Kingdom (8.8 million members / €5.6bn revenue), France (5.2 million members/ €2.4bn revenue), Italy (5.1 million members/ €2.2bn revenue) and Spain (4.9 million members/ €2.1bn revenue) already account for 64 per cent of the European market in terms of both membership and total revenues (Figure 1, p58) all five countries continue to grow and offer further potential, with penetration rates currently between 7 and 14 per cent.

This is in contrast to Norway, Sweden and the Netherlands, which have already reached penetration rates of 19.4, 16.7 and 16.4 per cent respectively.

At the same time, Turkey and Russia – with relatively large populations – have shown rapid development in the provision of fitness opportunities. Both countries still display considerable potential, with more than 47,000 inhabitants per club and penetration rates of just 2.4 per cent (Turkey) and 1.9 per cent (Russia).

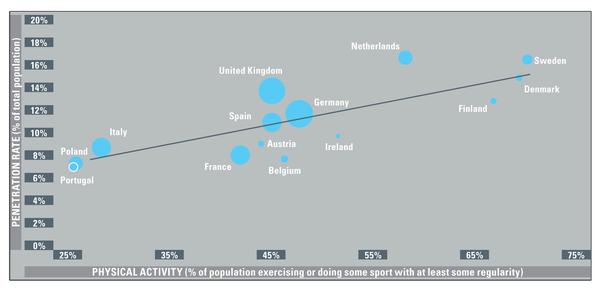

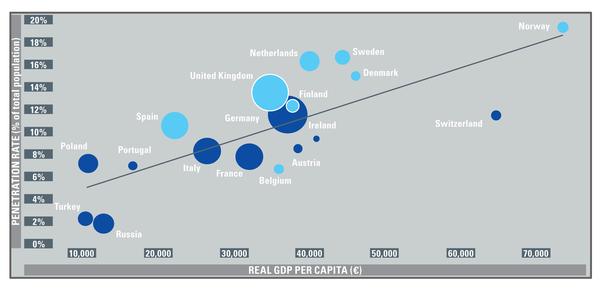

The report found that penetration rates were primarily correlated to three macro-economic factors: the general physical activity of the population, a country’s gross domestic product per capita, and the degree of urbanisation – all of which positively impact fitness membership (Figure 3, p60 and Figure 4, above).

Thus, countries with a large percentage of the population exercising or doing sport (source: EU Eurobarometer 2013) – such as Sweden, Denmark and Finland – are among the leaders in terms of fitness market penetration, while less active countries like Poland or Portugal have relatively low percentages of members.

Likewise, countries with a high real GDP per capita and high degree of urbanisation – like Scandinavia and the UK – have the highest penetration rates, whereas lower ranked countries like Russia and Turkey have less developed fitness markets.

If physical activity and disposable income continue to grow, the fitness industry has a great opportunity to benefit.

FIGURE 1:

Top 10 European fitness markets by revenue in €m and share of total European market (2015)

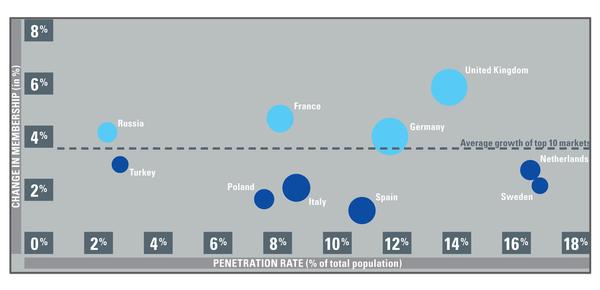

FIGURE 2:

Total membership, membership growth and penetration rate of top 10 European fitness markets (2015)

Notes: Light blue bubble represents above-average growth markets, dark blue bubble represents below-average growth markets, bubble size represents total membership as of 2015.

FIGURE 3:

Correlation between physical activity and fitness market penetration (2015)

Notes: Physical activity is based on the percentage of the population that is exercising or doing sport ‘with some regularity’ or ‘regularly’ according to the EU Eurobarometer 2013. Bubble size represents total membership as of 2015.

FIGURE 4

Correlation of real GDP per capita and urbanisation with fitness market penetration (2015)

Notes: Light blue bubble represents a country with an urbanisation rate of 80% or more, dark blue bubble represents a coutry with an urbanisation rate of less than 80% (according to The World Bank); The urban population, as stated by The WorldBank, refers to people living in urban areas as defined by national statistics offices. It is calculated using World Bank population estimates and urban ratios from the United Nations World Urbanization Prospects. Bubble size represents total membership as of 2015.

WANT TO KNOW MORE?

Karsten Hollasch is partner at Deloitte and head of the German Sports Business Group. Herman Rutgers is a board member, chair of events and research director for EuropeActive. A hard copy of the report can be purchased via the EuropeActive website: www.healthclubmanagement.co.uk/europeactive

The report costs €95 for EuropeActive members or €195 for non-members, plus delivery.

Duty Manager Golf and Athletics

Leisure Centre Duty Manager

Leisure Supervisor (Development)

Recreation Assistant (Dry Site)

Party Leader

Cleaning Assistant

Duty Manager

Duty Manager

Centre Manager (Leisure)

Director of Operations

Fitness Motivator

Recreation Assistant/Lifeguard (NPLQ required)

Recreation Assistant

Swim Teacher

Swim Teacher

Chief Executive Officer, Mount Batten Centre

Swimming Teacher

Swimming Teacher

Company profile

Featured Supplier

Property & Tenders

Company: Knight Frank

Company: Belvoir Castle

Company: AVISON YOUNG

Company: London Borough of Bexley

Company: Forestry England