Consumer spending

A welcomed legacy of the London 2012 Games has been an increase in consumer spending on sport. Themis Kokolakakis from Sheffield Hallam University's Sports Industry Research Centre (SIRC) looks at the figures

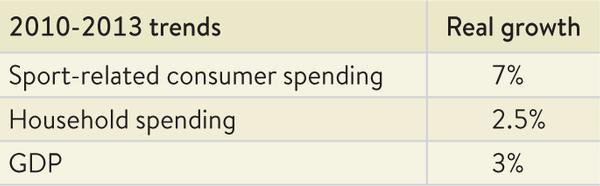

A very important question in the sport economy is its relationship with economic growth. Throughout the years that we've monitored the sport economy at SIRC (we keep detailed data going back to 1985) invariably sport spending declines in real terms each time we face recession. This is not surprising; sport follows the general leisure spending pattern where people, at times of hardship, firstly sacrifice aspects of their leisure life. For example, an expensive health club membership can be replaced by a much cheaper involvement in a sports club. To establish this fundamental behaviour Table 1 (image) includes data of growth (or decline), in real terms, that occurred in the overall household spending and its sporting element, together with observations about recessions in the economy. All these data are methodologically consistent and comparable over time, going back to 1990.

Two clear statements can be established. Firstly, each recession in the past 25 years has been accompanied by a fall in both total household spending (in real terms) and its sporting component. Secondly, in all the pre-2010 data the sport economy did not require a recession to decline. A weak, sub 2 per cent growth in overall household expenditure would bring about a decline in sport spending. This was clearly the case in 1990, in 1995 and in 2006.

Hence, for more than 25 years (prior to 2010) the general principle was that for the sport market to grow in real terms the overall household expenditure would need to grow by at least 2 per cent year-on-year. Sport spending was relatively down the list of priorities in the household budget. Indirectly it was a question of how much a household valued sport goods and services relative to other goods and services.

This introduces the obvious question of whether the London Olympic Games had an impact on consumers’ valuation of sport. Already, through recent research, we know that major sport events have a significant impact on the inspiration of the local population. The interpretation of such an ‘inspiration’ is unclear, yet it is reasonable to assume that both participation and consumer preferences would be affected. In the case of the Olympics the most intensive stage of preparations started in 2010. This coincided with an acceleration of construction activity and a greater media presence than before. 2010 was also the first year out of the 2008-9 recession. Hence it's very interesting to explore how the sport market behaved: is it the same story as explained earlier, or have the Olympics, already from its preparation stage, changed the conventional character of the market?

Between 2010 and 2013, changes in overall household spending ranged from a decline of -0.5 per cent in 2011, to a growth of 1.8 per cent. Under the pre-2010 paradigm, sport spending should have been in a continuous decline each year throughout this period. Yet the opposite occurred. Consumer spending on sport increased, often at double the rates of growth in overall expenditure.

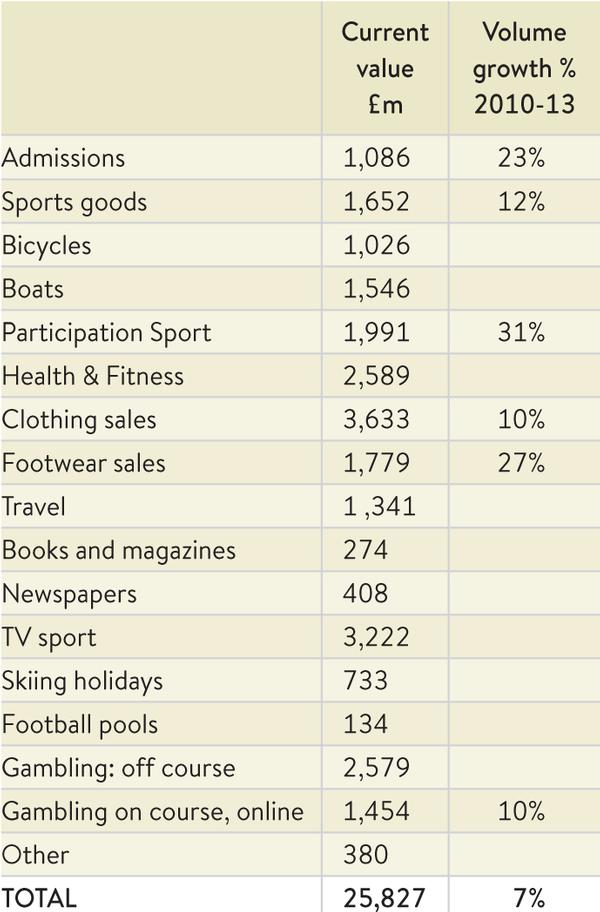

In 2011, a year before the Games, while total household spending declined by -0.5 per cent, the sport economy moved in the opposite direction – increasing in size. The experience of 2010-13 suggests a new sporting landscape where consumers’ preferences have shifted in favour of sporting goods and services. As Table 2 illustrates (image), during 2010-13 the sport economy grew by 7 per cent in real terms, compared to a 3 per cent growth in GDP and 2.5 per cent in household spending.

This suggests the possibility of expanding business potential and at the same time increasing sports participation. The new profile of the sport economy, growing substantially during economic slowdown, creates new economic opportunities for the sector in terms of commercial funding (likely to be undervalued as now sport represents a lesser risk), and much greater returns to the central government in the form of taxes.

A more detailed look of 2013 sport-related spending estimates reveals further dynamics. The total value of the sport market in the UK in 2013 was £25.8bn representing a growth of 2.2 per cent in real terms. This is contrasted to a smaller change in overall household spending (1.8 per cent) and an even weaker growth of GDP at 1.5 per cent, validating the post-2010 shift in the market. Sport is expected to grow further by 2 per cent in 2014 reaching £27bn in value.

Table 3 illustrates (image) the detailed distribution of the UK sport market in 2013 (estimates). This is combined with the most dynamic growth rates for the period 2010-13 in real terms. Clearly the most important markets are participation- related. Participation sport itself excluding health and fitness leads the way in terms of growth (31 per cent) followed by footwear (27 per cent), admissions (23 per cent) and sport goods (12 per cent). The increase in admissions was mostly realised within a single year (2011) and is mostly related to the Olympics. The most dynamic category of participation sport is to a great extend related to the UK’s 151,000 sport clubs.

The latter increased their participating adult membership by 21 per cent during the period 2011-13, a trend consistent with our estimates of participation-related spending (based on Family Spending statistics). Despite the disproportionate ‘weight’ of the Games, admission spending, in growth terms, fell below two important participation-related categories, bringing justifiable expectations for sports participation growth in the future.

Commercial Fitness Manager

Exercise Referral Co-ordinator

Assistant Regional Director

Sport Centre Team Leader

Team Leader BSV

Lifeguard/Recreation Assistant

Casual Swim Teacher

Team Leader

Lifeguard/Recreation Assistant

Leisure Centre Deputy Manager

Duty Manager

Duty Manager Golf and Athletics

Centre Manager (Leisure)

Fitness Motivator

Recreation Assistant/Lifeguard (NPLQ required)

Recreation Assistant

Swimming Teacher

Swimming Teacher

Company profile

Featured Supplier

Property & Tenders

Company: Knight Frank

Company: Belvoir Castle

Company: AVISON YOUNG

Company: London Borough of Bexley

Company: Forestry England