The data age

Moving Communities represents a watershed moment in how the public sector is using data to inform strategic decision making. 4global Consulting’s Ed Hubbard reports...

As soon as government restrictions closed the doors of clubs and leisure centres, it became apparent the industry was in need of emergency funding to ensure facilities could re-open safely and effectively as soon as they were allowed.

To enable this, Sport England secured £100m, provided by the Exchequer via the National Leisure Recovery Fund (NLRF), working with local government and allowing local authorities to support operators when they re-opened.

Through the application process and allocation of funding, it became clear that in order to invest efficiently and report on the effectiveness of this recovery funding, a greater focus and understanding of data was required across the public sector.

So Moving Communities was born, a digital transformation programme designed to bring consistent reporting standards across the sector and to provide data and insight on the recovery and performance. Moving Communities has been working with leisure operators and local authorities, to aggregate live data integrations which are automatically standardised and presented in platforms and graphical reports. For the first time, we have a comprehensive view of operational and financial performance for the public leisure sector.

“Never before has our sector placed such a focus on collecting data and this will be key to the recovery,” says Dr Steve Mann, director at 4global Consulting. “We must ensure the recovery is needs-led and insight-driven, making the most of exciting developments for data collection and analytics capabilities across the sector.”

Transparent understanding

Moving Communities is enabling stakeholders to understand how, why and where people are returning to leisure facilities. The dashboards within the platform can be viewed by both local authority clients and operator delivery partners, ensuring a consistent and transparent understanding and approach to data and reporting.

All local authorities and operators involved in Moving Communities can see the performance of facilities on the platform, which also benchmarks local performance against statistical neighbours and national figures. Infographics and insight reports are also being published regularly, presenting the key sector KPI’s and providing greater depth on specific demographic groups.

As reported in HCM 2021 issue 3, Moving Communities is led by Sport England and delivered by a group of partners including Leisure-net Solutions, the Sport Industry Research Group at Sheffield Hallam University, 4global, Max Associates and Quest, with the delivery model building on the repurposed the National Benchmarking Survey (NBS).

ukactive also plays an important role, building on previous Moving Communities reports and engaging members to ensure comprehensive data supports the growth of the whole sector. All local authorities which benefit from the NLRF funding are part of the Moving Communities service, which benchmarks income, expenditure, participation, social value and the customer experience.

Customer experience has been measured through a national online survey, which is the largest experience survey of its kind undertaken in the sector, with more than 1,000 leisure facilities taking part.

According to Leisure-net director, Mike Hill, the aim is to understand more about behavioural changes and the motivations of participants: “We want more than 50,000 completed customer experience surveys, giving us further feedback on potential barriers and challenges associated with the return to facilities.”

Tracking the recovery

This project represents a step change in the way the sector uses data to demonstrate our impact, or to inform operational planning. The critical need for this was demonstrated during the pandemic, as the industry’s ability to lobby was dependent on the robustness of evidence we could provide. A key objective of Moving Communities is to put regular, compelling insight into the hands of decision-makers, to drive further investment and support.

Throughout the summer and into autumn, as operators and local authorities strive to get back to 2019 levels of usage, Moving Communities will measure and evidence the sector’s recovery from the pandemic. We will see how behavioural and societal changes, such as a greater proportion working from home, affects the longer-term performance of the industry and explore how the pandemic has contributed to health inequalities. This insight will enable time, effort and money to be invested in way which will benefit those communities who need the most help, allowing us to evidence, shape and motivate the nation to get active.

Moving Communities will be a central part of future engagement with the healthcare industry and a tool which enables services to be marketed to new audiences in different ways. What we have seen so far is the tip of the iceberg, with huge potential just under the surface if we continue to develop as a sector.

"We must ensure the recovery is needs-led and insight driven, making the most of exciting developments for data collection and analytics capabilities across the sector" – Dr Steve Mann, director at 4global Consulting

"We want more than 50,000 completed customer experience surveys, giving us further feedback on potential barriers and challenges associated with the return to facilities" – Leisure-net director, Mike Hill

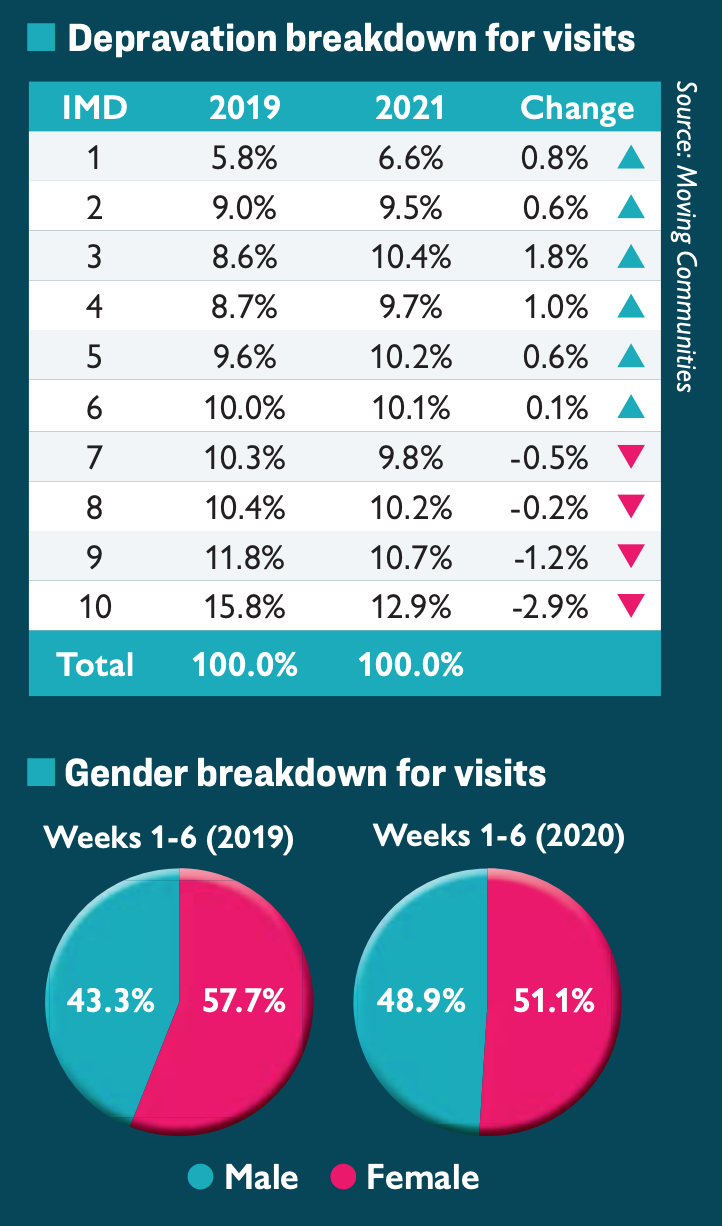

Insight from the first six weeks of Moving Communities’ reporting demonstrated the early trends of the demographic profiles of early returners. A greater proportion of male participants have returned, compared to 2019, which is likely to have been driven by restrictions on group exercise. Younger age groups have also shown a higher return rate than older adults.

Early data indicates a greater proportion of participation in leisure centres has come from people in more deprived areas, compared to the same time period in 2019. While there is still higher total participation by those from less deprived areas, the distribution across the Index of Multiple Deprivation deciles is more balanced than before the pandemic.

Swim Manager

General Manager

General Manager

Swim Teacher

Customer Service Advisor

Sports Facility Manager - LSBU Active

Team Leader

Fitness Motivator

Swim Teacher

Duty Manager (Dry)

Head of Operations

Senior Leisure Officer

Swimming Teacher

Swimming Teacher

Company profile

Featured Supplier

Property & Tenders

Company: Jersey War Tunnels

Company: Savills

Company: Cotswold Lakes Trust

Company: Knight Frank

Company: Belvoir Castle